Protected Cell Companies (PCC) in Mauritius All you need to know

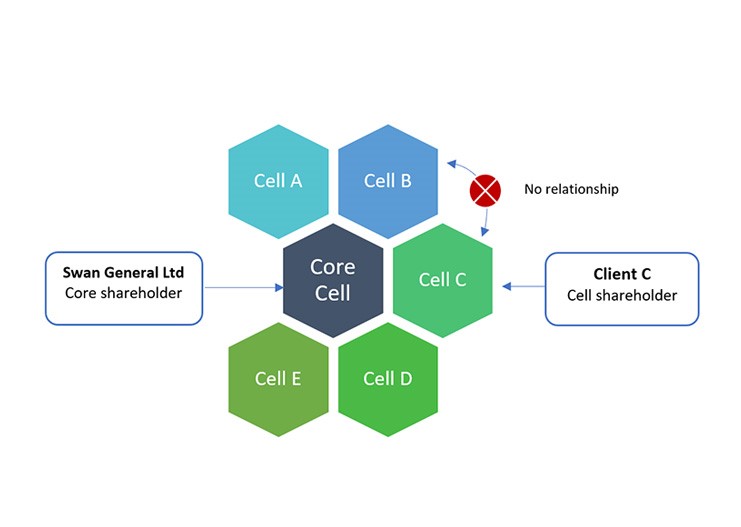

As each cell of an ICC is a company with separate legal identity, the treatment of segregation is straightforward, with assets and liabilities being held separately within each incorporated cell. Jersey insolvency. Jersey law applies the same 'ring-fencing' doctrine to liquidators and receivers of PCCs and protected cells.

PPT Protected Cell Company PowerPoint Presentation, free download ID1671268

PCC is a protected cell company. Application for consent under the Companies Law is made to the GFSC in writing and, if granted, the GFSC has the power to vary or revoke its consent or impose any new term or condition in relation to its consent. Although the Companies Law is drafted restrictively to state that a company may not be incorporated as a

PPT Protected Cell Company PowerPoint Presentation, free download ID1671268

Protected Cell Company ("PCC") is a limited liability company and has a board of directors. Like a traditional company a PCC has a single separate legal personality, it is distinct from both its members and directors and is subject to the provisions of the Isle of Man Companies Acts. However it differs from a conventional company in that a.

Jersey Protected Cell Company (PCC) Formation and Benefits

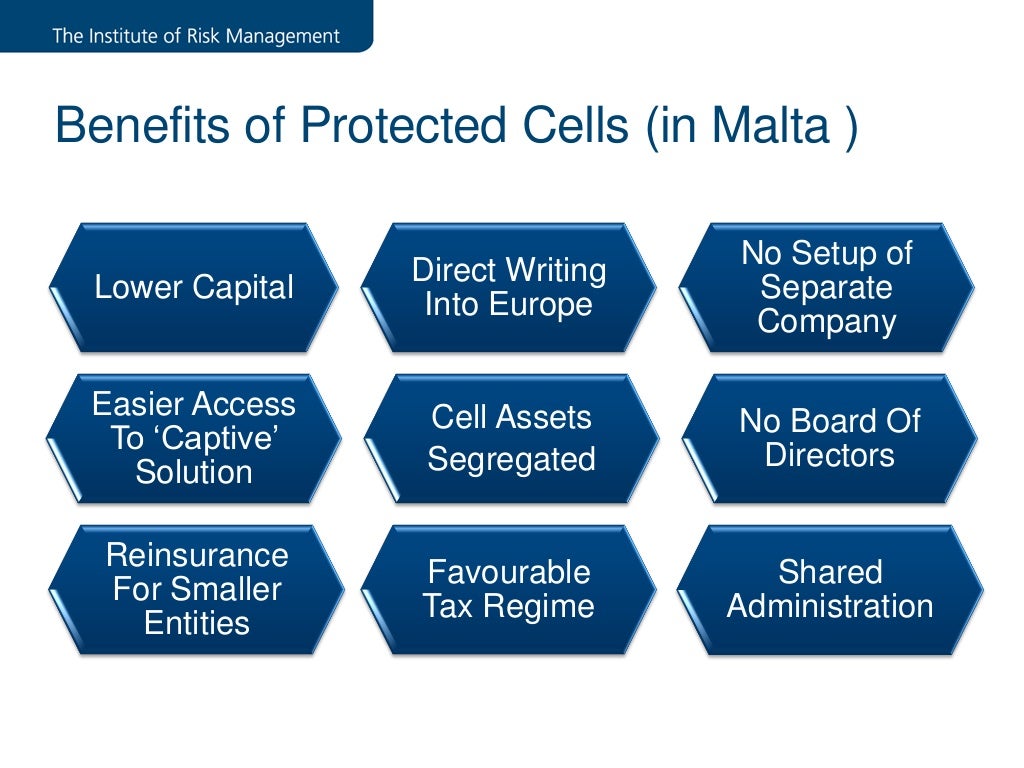

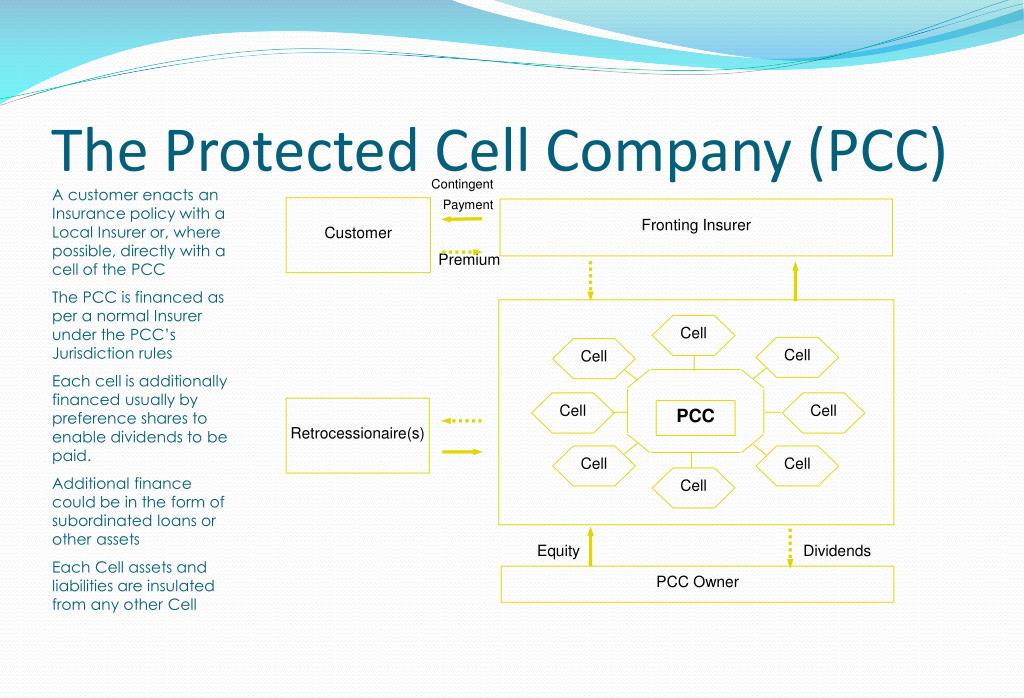

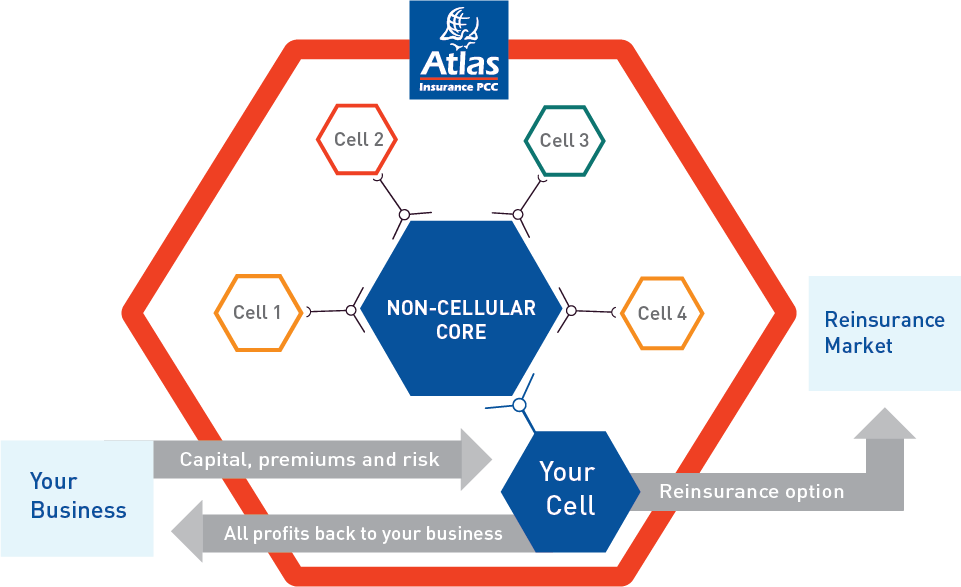

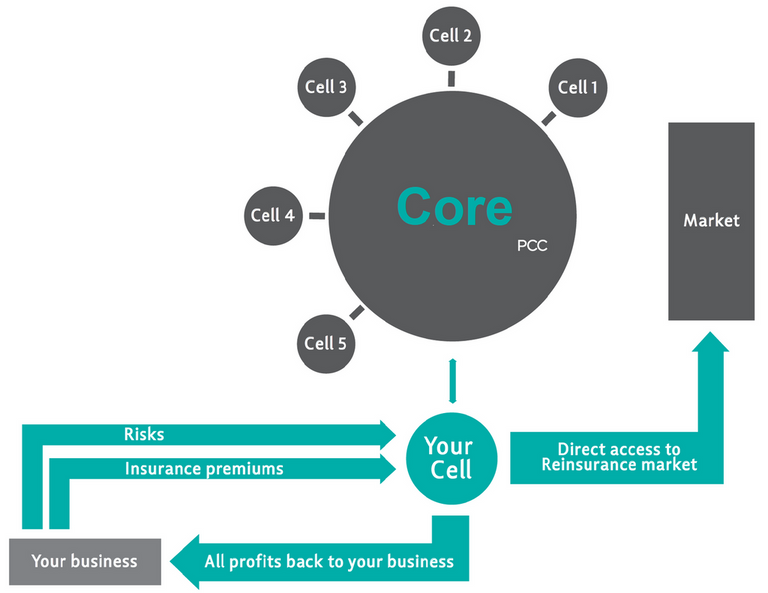

the Subsidiary Legislation 386.10 Companies Act (Cell Companies Carrying on Business of Insurance) Regulations, as amended by Legal Notice 391 of 2015. It is a single legal entity. There are two parts to the PCC namely, a non-cellular part (the Core) and protected cells (the cells). The number of cells is not limited.

PPT Protected Cell Company PowerPoint Presentation, free download ID1671268

Segregated portfolio company. A segregated portfolio company (or SPC ), sometimes referred to as a protected cell company, is a company which segregates the assets and liabilities of different classes (or sometimes series) of shares from each other and from the general assets of the SPC. Segregated portfolio assets comprise assets representing.

AAcapital

Protected Cell Companies - 25 years in. Peter Child is CEO of SRS Europe and Managing Director of SRS Guernsey. Twenty-five years ago Protected Cell Company ('PCC') legislation was enacted by the States of Guernsey introducing the world to the concept of the cellular company. A number of local legal, and insurance practitioners were.

Evolution Insurance PCC Cell Captive Case StudyEvolution PCC

Protected Cell Captive Insurers Rather than pool its insureds' risks, a rental captive may keep a separate underwriting account for each insured participant. In some domiciles, these accounts are legally separated or protected, and the term "cell captive" or "protected cell company (PCC)" is used, indicating that each insured's assets are kept.

EU Insurance Protected Cells Captives on a Budget

What is a Protected Cell Company? A PCC is an insurance vehicle whereby multiple 'cells' are connected to a core; creating a single legal entity. A 'cell' is an insurance facility that can be rented by a single company to underwrite its specific risks - a form of risk retention vehicle. The PCC sponsor sets up the core, which manages.

PPT Protected Cell Company PowerPoint Presentation, free download ID1671268

The Companies (Jersey) Law, 1991 (the " Companies Law ") permits the creation of two types of cell company: the Incorporated Cell Company and the Protected Cell Company. The distinction between the two entities is straightforward, but significant. An ICC creates incorporated cells: these cells are separate companies with their own legal.

Protected Cell Companies Business Consult

That's the essence of a Protected Cell Company (PCC): a single legal entity with distinct, ringfenced compartments called cells, each housing its own business activities and assets. What is a Protected Cell Company (PCC)? A PCC is a unique corporate structure offering flexibility and risk management benefits. It acts as a single legal entity.

Protected Cell Company Blue Azurite

Protected Cell Company (PCC): A Protected Cell Company (PCC) is a corporate structure in which a single legal entity is comprised of a core and several cells that have separate assets and.

Atlas Protected Cell Company facilities Atlas Insurance PCC

Incorporated Protected Cell Company •An Incorporated Cell Company ("ICC") is a company which has the power to establish incorporated cells as part of its corporate structure. Like a PCC, an ICC may comprise any number of incorporated cells. However, unlike a protected cell of a PCC an incorporated cell has many of the attributes of a non.

Protected Cell Companies SWAN Mauritius For Life

A protected cell structure involves a single legal entity (the "protected cell company" or "PCC") within which there may be established numerous protected cells. Each protected cell, despite.

Insurance Entities Protected Cell Companies PCCs, Solvency II and Gibraltar Gibraltar

A protected cell company (PCC) is a unique corporate structure, resembling a hub and spoke, where a central core is linked to individual cells, each with separate assets and liabilities. Governed by a single board of directors, a PCC offers legal advantages, such as separate treatment for cells during bankruptcy..

Protected Cell Company

A Protected Cell Company ("PCC") is a single legal entity comprised of a core, and a number of segregated parts, or "cells.". A PCC is formed by a sponsoring entity. The sponsor (in this case Marsh) manages the PCC through a Board of Directors and provides minimum regulatory and operating capital (the "core").

PPT DOING BUSINESS IN THE ISLE OF MAN Stuart Foster sfosterburleigh.co.im PowerPoint

A cell company is simply a company that can create one or more cells that contain assets and liabilities that are distinct from its own assets and liabilities and from those of any other cells that it may create. There are two types of cell company available in Jersey; the Protected Cell Company (PCC) and the Incorporated Cell Company (ICC.